|

Accelerate Your Rich Mindset: A Year of Momentum

Discover the rhythm of financial success! Pacing & Gaining Momentum is our them for 2024, urging First-Gen high-income earners to shed limiting mindsets. Embrace uncomfortable financial habits that accelerate your journey to a rich mindset.

We are rooting for you, every step of the way! Cheers to your financial success, your mental well-being, and the pursuit of caring for your family for generations to come.

New Money💸, Old Beliefs: Breaking the Mold for First-Gens!💡

|

|

Explore the secrets shaping your money mindset, uncovering the myths holding back first-gen high income earners, and step into a brighter financial future🌟💰

The ideas we have about money can really affect how first-generation high earners make financial choices.

These beliefs often come from our culture, family, or what society expects, shaping how we see wealth and success.

Limiting Beliefs by Generation

Baby Boomers—Born ~1946-~1964

- Savings accounts are safer than investing in the stock market.

- Debt is always a bad thing and should be avoided at all costs.

- Women should focus on household finances, not investments.

- Discussing money matters is considered impolite.

Gen X—Born ~1965-~1980

- Investing is only for the wealthy; I can't afford it.

- The stock market is too risky; better to keep money in savings.

- Financial success is measured by material possessions.

- Money should be a private matter; avoid discussing it with friends.

Gen Z—Born ~1965-~1980

- Investing in cryptocurrencies is a smart financial move.

- Open discussions about money are crucial for learning and growth.

- Experiences and travel are more valuable than material possessions.

- Investing in environmentally sustainable companies is a priority.

It's important to recognize and question these beliefs to create a better mindset about money and reach financial empowerment.

Clearly there are disconnects in the purpose of money as shown in the above limiting beliefs described for each generation.

While each generation may hold a diverse range of beliefs and experiences, it's fair to say there is a common thread for the purpose of money which can be summarized as--

- Money serves the purpose of providing financial security, ensuring stability and comfort;

- Money is a means to enhance the quality of life, whether through experiences, leisure, or personal pursuits.

-

Money plays a crucial role in securing the well-being and future opportunities for their own and subsequent generations.

|

Unlock the secrets shaping your money mindset, liberate from myths holding back first-gen high income earners.

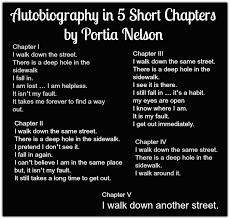

Just like Portia Nelson's poem (below), recognize the path, evolve beliefs, and gain financial clarity.

Here are few things to consider, encourage you to be honest, to critically examine your beliefs, understand their impact, and create space for personal growth and empowerment.

- Consider the origins of your beliefs. Are they inherited, learned, or self-discovered? Understanding their roots unveils the potential for change."

- Beliefs can evolve. Ask yourself, 'Are my beliefs serving my growth, or are they holding me back?'"

- Distinguish between personal beliefs and those imposed by society, culture, or family. Are you living by your rules or someone else's?"

-

Recognize beliefs as filters shaping your reality. Are they enhancing or distorting your perception of opportunities and possibilities?"

- Challenge assumptions within your beliefs. What if your long-held belief isn't an absolute truth but a conditioned perspective?"

- Do your beliefs define who you are, or do they limit your potential? Consider separating self-identity from restrictive beliefs.

- Acknowledge the difference between beliefs and facts. Are your beliefs based on evidence, or are they assumptions that might not hold true?

- Your life story is shaped by beliefs. Are you ready to edit the narrative, transforming limiting beliefs into empowering chapters?

- Uncover if fear or comfort is driving your beliefs. Are they keeping you safe, or are they hindering your exploration of new possibilities

-

When you want to grow, adopt a growth mindset. Embrace challenges as opportunities to learn and evolve, challenging beliefs that hinder your personal development."

Understanding these insights is vital for a brighter financial future, paving the way to empowered and informed decision-making.

|